Teaching children about money is very important these days. As digital banking becomes more prevalent, it is essential to prepare them for the realities of spending, saving, and practicing smart finance. HyperJar Kids offers a more modern and effective way of tackling these issues through a more tech-based approach. This article explains everything about HyperJar Kids and how it can be beneficial for families.

What is HyperJar Kids?

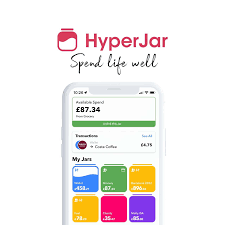

HyperJar Kids is a new feature that is part of the HyperJar app, allowing the whole family to engage with it. HyperJar Kids allows parents to set up ‘jars’ to manage allowance and spending with children which teaches them important financial responsibilities. The hands-on experience provided properly prepares children for a financially independent future.

HyperJar Kids helps with straightforward and simple financial education. Early indoctrination in finance is important and this app provides an effective way which instills good decision-making. This enables parents and children to nurture a good relationship with money using modern tools and methods.

Why Choose HyperJar Kids?

HyperJar Kids is known and appreciated because of its ease of use and practical advantages. Unlike traditional methods such as piggy banks, money can now be digitally stored, tracked, and managed. The app successfully integrates fun and responsibility, making the learning process enjoyable but impactful.

How Does HyperJar Kids Work?

HyperJar Kids is based on the principle of digital jars where each jar is a spending or saving goal. It is possible for parents to assign pocket money straight towards these jars. Children are then able to spend using their prepaid HyperJar cards, but only from specific jars within set limits.

Parents and children can see spending history, balances, and goals making it easier to monitor transactions. Moving away from cash-based allowances to a digital system has never been easier.

Step-by-Step Overview

- Set Up Linked Accounts

Parents create a child profile within the HyperJar app, which creates a controlled and safe space for the child to operate in.

- Create Jars for Goals

Decide together what the spending or saving categories are. “Birthday Gifts” or “New Toys” could be examples of jars.

- Load Allowances

Use the app to deposit funds into the child’s jars. Parents have the option to automate this process for recurring allowances.

- Spend With HyperJar Card

Children are issued pre-paid cards linked to their jars which allows them to only access the funds available in jars set for spending.

- Monitor and Learn

Money tracking can be done by both parents and children teaching them responsible spending.

Important Elements of HyperJar Kids

HyperJar Kids incorporates certain elements which make learning about finances easier and more useful for the kid’s age group. Here’s what families have to look forward to:

1. Visual Savings Goals

Saving becomes easier for kids because they can see the jars. Each goal is represented by a color-coded jar which clearly shows kids what they are saving towards.

2. Controlled Spending

Kids learn to spend within their means with pre-paid cards. Spending can only be done with designated jars for specific spending, and amounts can be set to limit overspending.

3. Real-Time Notifications

Parents can immediately see how their children are spending money. This visibility fosters responsibility and allows for immediate action when necessary.

4. Goal Tracking

Children can have specific savings targets, for example, saving for a bike. They are equipped with progress trackers which motivates them to work towards and surpass the target.

5. Interest-Free Money Allocation

Through HyperJar’s exclusive model, families can set money aside with retail partners and even save by securing discounts.

6. No Hidden Fees

Unlike most financial tools, HyperJar Kids does not have a subscription fee or any other charges. The tool is straightforward and provided an accessible solution for families.

Advantages for Parents and Kids

HyperJar Kids isn’t simply an application. As an educational tool it provides tangible advantages for both children and parents.

Benefits for Parents

- Enhanced Oversight

The app allows parents to manage how their children use and spend money.

- Customizable Rules

Parents have the option to set specific restrictions or grant permission to remove rules based on their child’s level of development.

- Lifetime Skills

Financial skills taught in childhood can lead to success in other parts of life.

- Safety and Security

Unlike credit cards, the pre-paid card offers added safety by ensuring the funds can’t be overspent or monitored.

Benefits for Kids

- Handling Funds With Care

Children gain confidence in managing funds after an extensive hands-on experience.

- Safeguarding Funds

The ability to either spend or save helps children understand how to control themselves.

- Controlled environment for Errors

The environment encourages risk-taking by allowing for errors, thereby helping children learn.

Maximize HyperJar Kids benefits.

Families can maximize benefits and gain more value from HyperJar Kids by integrating it into family routines. Here are suggestions on how to make the most out of it:

Always include your child in discussions regarding their allowance so they can reap as much benefits as possible. Encourage children to work together rather than focus on individual efforts while budgeting to help foster collaboration.

Illustrate lessons taught using the app with real-life scenarios and explain how the app is useful in real life.

Illustrate how saving for a vacation jar aids in family outings.

Reward Progress

Provide a positive outcome for achieving a milestone. Kids are easier to motivate with tangible rewards.

Comparison with Competitors

HyperJar Kids isn’t the only tool for teaching money management, but it has clear advantages. Finding families who love it reveals much through comparison.

HyperJar Kids vs. Traditional Piggy Banks

Unlike piggy banks, which can only store money, HyperJar Kids allows for real-life cash flow spending.

Kids learn digital transaction skills, which is crucial in today’s cashless society.

HyperJar Kids vs. Bank Accounts

HyperJar Kids offers greater visibility and control relative to debit accounts issued to minors.

The pre-paid card removes the possibility of accruing debt, ensuring expenses stay within set limits.

HyperJar Kids vs. Other Apps

Family finance applications do not offer the same bespoke features as HyperJar Kids.

Its jar-centered system perfectly suits goal-driven savings.

Frequently Asked Questions About HyperJar Kids

Is there an age limit for HyperJar Kids?

The app best suits children from age six and up as it has varying layers of complexity.

Can kids transfer money between jars?

Yes, kids can adjust their funds under adult supervision to improve their financial management.

Does the card work internationally?

The card is pre-paid, meaning it can be used locally and internationally without issue.

How secure is the app?

Comprehensive encryption and security measures safeguard accounts from breaches with unauthorized accounts.

What happens when the card is lost?

Via the app, parents have instant capability to unlock the card. Lost cards can be easily and quickly replaced.

What Makes HyperJar Kids Unique

HyperJar Kids offers families a creative approach to long-term learning. It goes beyond the basics of teaching financial literacy; it puts the power in children’s hands to manage their money. It helps close the gap between traditional lessons on money and today’s banking issues by integrating technology with meaningful engagement.

HyperJar encourages important conversations about financial responsibility by fostering saving towards goals like dream toys or weekend adventures. This provides children the opportunity to develop a strong understanding of money management from a young age.

Conclusion

HyperJar Kids turns the mundane task of managing an allowance and transforms it into a meaningful learning opportunity. The skills children acquire will help them navigate a complicated financial future. For parents, there is great peace of mind knowing their children are gaining life skills in a safe, supervised setting.

HyperJar Kids offers families a revolutionary gift by empowering children with healthier financial habits through technology. Its real-life relevance, engaging interactivity, and family-friendly approach truly set it apart for modern families.

READ MORE; Thincats….